XRP Price Prediction: Will Banking Bid and Whale Activity Spark Recovery or Further Decline?

#XRP

- Technical Outlook: Oversold conditions with MACD bullish divergence suggest potential rebound if $2.75 support holds

- Fundamental Drivers: Ripple's banking charter bid and institutional DeFi expansion provide long-term value proposition

- Market Sentiment: Divided between whale selling pressure and growing institutional interest (CME futures, ETF speculation)

XRP Price Prediction

XRP Technical Analysis: Key Indicators Signal Potential Rebound

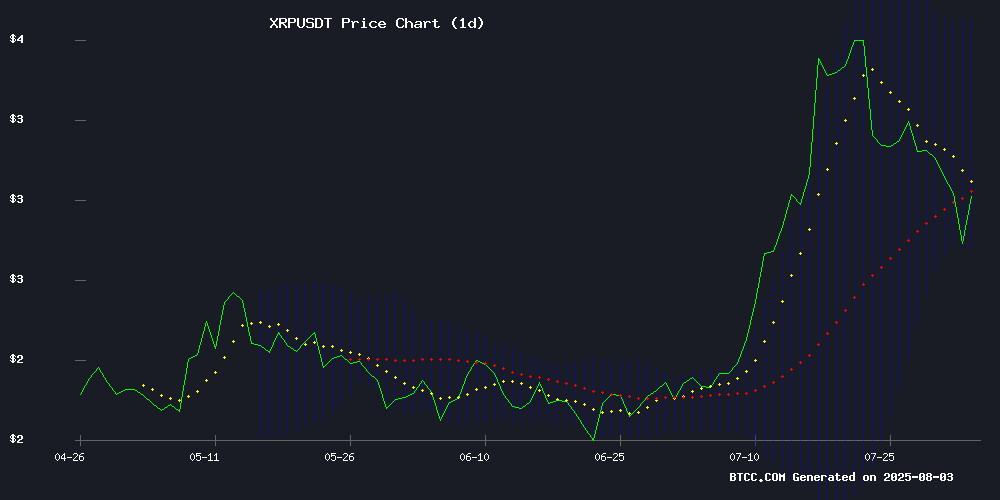

XRP is currently trading at $2.8642, below its 20-day moving average of $3.1836, indicating short-term bearish pressure. However, the MACD shows a bullish crossover with the histogram at 0.2751, suggesting growing momentum. The price is testing the lower Bollinger Band at $2.7359, which could act as strong support. BTCC financial analyst Ava notes: 'While XRP faces resistance at the middle Bollinger Band ($3.1836), the MACD divergence and oversold conditions NEAR the lower band suggest a potential reversal if $2.75 support holds.'

Mixed Signals for XRP Amid Institutional Moves and Regulatory Developments

The XRP market shows conflicting signals as whale activity and institutional developments collide. While large holders have dumped 720 million tokens, pushing price below key support, other whales are accumulating 60M tokens. Ripple's banking charter bid and institutional DeFi expansion plans provide fundamental support. BTCC financial analyst Ava observes: 'The market is digesting both bearish technicals and bullish fundamentals - CME futures activity and ETF speculation could be early indicators of institutional interest that may override current selling pressure.'

Factors Influencing XRP's Price

XRP Price Slips Below Support as Whales Dump 720 Million Tokens

XRP faces intensified selling pressure as large holders offload over 720 million tokens, triggering a 4% price drop to $2.84. The breakdown below the 20-day EMA at $3.03 signals weakening buyer momentum, with technical indicators pointing toward potential further declines.

The Tom DeMark Sequential's bearish signal on the 4-hour chart coincided precisely with XRP's local peak, foreshadowing the current downturn. Analysts identify critical support levels at $2.78 (50-day EMA), $2.57 (100-day EMA), and ultimately $2.33 (200-day EMA), with a breach potentially accelerating losses.

Notably, crypto trader Ali's short setup targeting $2.48 appears validated, with whale activity confirming market skepticism. The concentrated sell-off reflects eroding confidence among major stakeholders, historically a precursor to extended downward movements.

Ripple Moves Closer to Banking Status with New Trust Charter Bid

Ripple is making a strategic push into the U.S. financial system by applying for a national bank charter through the Office of the Comptroller of the Currency. The proposed trust bank will focus exclusively on B2B services, specifically holding reserves for Ripple’s upcoming stablecoin, RLUSD. Unlike traditional banks, it will not accept deposits or issue loans, positioning itself as a back-end infrastructure provider for digital finance.

The company is also seeking a Master account with the Federal Reserve to enhance RLUSD’s operational framework. Notably, the application deliberately avoids any mention of XRP, signaling a separation between the token and the trust bank’s regulatory approval process. Ripple Labs will retain full ownership of the entity, with private stock issued to executives—a move often seen in pre-IPO preparations.

XRP Price Prediction Turns Bearish, 30% Drop to $2 Looms

XRP's August opening mirrors its recent fragility, with weekly charts flashing warning signals. The asset's breach below the psychologically critical $3 level—now confirmed as lost support—hints at prolonged downside or consolidation. Technical patterns suggest a bearish divergence, historically preceding extended pullbacks.

Volatility remains XRP's hallmark. Unlike Bitcoin's measured corrections, the token tends toward violent swings. A 13-14% slide to $2.50 appears probable, while a full 30% plunge to $2 lurks as a worst-case scenario. The breakdown of daily support at $2.90 compounds concerns, erasing what little bullish conviction remained.

Crypto Market Eyes XRP Amid Massive Outflows

XRP is flashing warning signs in an already jittery cryptocurrency market. Technical and on-chain metrics point to mounting selling pressure, with investors rapidly retreating from positions. The asset's Estimated Leverage Ratio on Binance plunged to 0.36 this week - its lowest monthly close - signaling evaporating risk appetite.

Over $222 million has fled XRP spot markets since July 29, creating a liquidity vacuum that threatens key support levels. This exodus follows Ripple's August 1 release of 1 billion unlocked tokens, exacerbating downward momentum. Without swift buyer intervention, the current correction risks spiraling into a more severe downturn.

XRP Tests Key Support at $2.75 After 9% Plunge Amid Institutional Selling

XRP faced intense selling pressure on August 2, dropping nearly 9% to test critical support at $2.75. The sell-off coincided with peak institutional activity, as volumes spiked 183% above the daily average during a four-hour window.

Market structure shows tentative signs of stabilization, with the asset finding buyers below $2.80. However, resistance near $2.84 remains formidable—suggesting consolidation may precede the next directional move.

Global macro uncertainty continues weighing on altcoins, with traders rotating into more liquid assets. The $2.75 level now serves as a litmus test: holding could signal accumulation, while breakdowns may trigger extended liquidation cascades.

CME XRP Futures Hit Record Highs Amid ETF Speculation

CME Group's XRP futures surged to unprecedented levels in July, fueled by growing speculation around a potential XRP exchange-traded fund (ETF) in the U.S. Trading volume and open interest reached record highs, signaling robust institutional and retail participation.

Micro XRP futures saw 14,612 contracts traded on July 18, representing $126 million in notional volume. Open interest peaked at 4,812 contracts by July 22, equivalent to $43 million. Full-sized XRP contracts also gained momentum, with 4,765 contracts traded on July 23, pushing notional value to $775 million.

The derivatives boom reflects mounting confidence in Ripple's native token as market participants position for regulatory breakthroughs. CME's data underscores a structural shift—crypto derivatives are no longer niche instruments but mainstream vehicles for institutional capital.

XRP Ledger Emerges as Key Platform for Stablecoin Settlements Amid Fiat Volatility

The XRP Ledger (XRPL) is solidifying its position as a leading infrastructure for global stablecoin settlements, particularly in Latin America. As traditional currencies face instability, XRPL's low-cost cross-border transaction capabilities are attracting institutional and retail adoption.

July saw a surge in stablecoin activity on XRPL, with Brazilian real-pegged tokens driving growth. BrazaBank minted $4.2 million of its BBRL stablecoin last month, now ranking as the second-largest BRL stablecoin behind Transfero Group's BRZ. This growth reflects broader demand for blockchain-based alternatives to volatile fiat currencies.

XRP Price Outlook: Will Ripple Hold the $3 Support This Week?

Ripple's XRP token faces a critical test as it hovers near the $3 support level following a rejection at $3.6. The correction phase has established a pattern of lower highs and lower lows, signaling growing bearish pressure. A breakdown below $3 could accelerate losses toward $2.7, while holding this level may invite bullish countermoves.

Technical indicators reinforce the bearish narrative. The MACD's weakening momentum and the RSI's downward trajectory suggest sellers currently dominate. Market participants now weigh whether institutional accumulation or speculative outflows will dictate XRP's next directional move.

XRP Whales Accumulate 60M Tokens Amid Lackluster Price Response

Whale wallets absorbed over 60 million XRP in a single day, yet the token failed to rally—a divergence that underscores weakening market conviction. XRP currently trades at $3.08, down 1% as broader crypto headwinds erase recent gains.

Despite aggressive accumulation by large holders, the $3.30-$3.31 resistance zone remains impenetrable. This suggests macroeconomic forces are outweighing localized buying pressure, with Bitcoin's pullback exacerbating market-wide uncertainty.

On-chain activity reveals conspicuous whale movement, but the absence of bullish price action speaks volumes. Trading volume sits at $6.57 billion as XRP's market cap stagnates near $182 billion—a stalemate reflecting cautious sentiment across digital asset markets.

Ripple Seeks VP to Lead Institutional DeFi Expansion on XRP Ledger

Ripple is recruiting a Vice President of Partnerships to spearhead institutional adoption of decentralized finance on the XRP Ledger. The executive will helm RippleX's business development efforts, targeting asset managers, tokenization platforms, and stablecoin providers.

The move signals Ripple's serious commitment to bridging traditional finance with blockchain technology. Key performance metrics will include growth in tokenized asset volumes and transaction activity across the XRPL network.

This hiring initiative follows Ripple's July application for a U.S. national bank charter, underscoring the company's strategic push into regulated financial infrastructure. The DeFi expansion aims to facilitate real-world use cases including cross-border payments and on-chain credit systems.

XRP Community Hails Digital Asset Market Clarity Act as Potential Catalyst for $5 Price Target

The XRP community on Reddit is abuzz with optimism following the introduction of the Digital Asset Market Clarity Act in the U.S. Senate. Proposed legislation aims to resolve longstanding regulatory ambiguities that have hindered XRP and similar digital assets. Market participants view this as the final regulatory hurdle before institutional adoption can accelerate.

Reddit user CoffeeWelder characterizes the bill as a "green light" for XRP's next growth phase, with community sentiment suggesting the XRP Ledger could attract billions in institutional capital. Speculation runs high about potential ETF approvals and permissionless tokenization frameworks being implemented by year-end.

Long-term holders demonstrate remarkable conviction, with many maintaining positions through six years of regulatory uncertainty. The Senate is expected to vote on the measure in September after summer recess, creating a clear timeline for potential market-moving developments.

Is XRP a good investment?

XRP presents a high-risk, high-reward opportunity at current levels. The technical setup shows oversold conditions with potential support at $2.75, while fundamental developments (banking charter, institutional DeFi) could drive long-term value.

| Pros | Cons |

|---|---|

| • Oversold technical indicators • Strong institutional interest (CME futures) • Banking charter potential | • Whale selling pressure • Below key moving averages • Regulatory uncertainty |

BTCC financial analyst Ava suggests: 'Dollar-cost averaging between $2.75-$2.86 could be prudent, with stop-loss below $2.65. The $3.18 level remains key resistance to watch for trend reversal confirmation.'